The Of Fortitude Financial Group

Table of ContentsUnknown Facts About Fortitude Financial GroupThe Of Fortitude Financial GroupFortitude Financial Group - QuestionsHow Fortitude Financial Group can Save You Time, Stress, and Money.

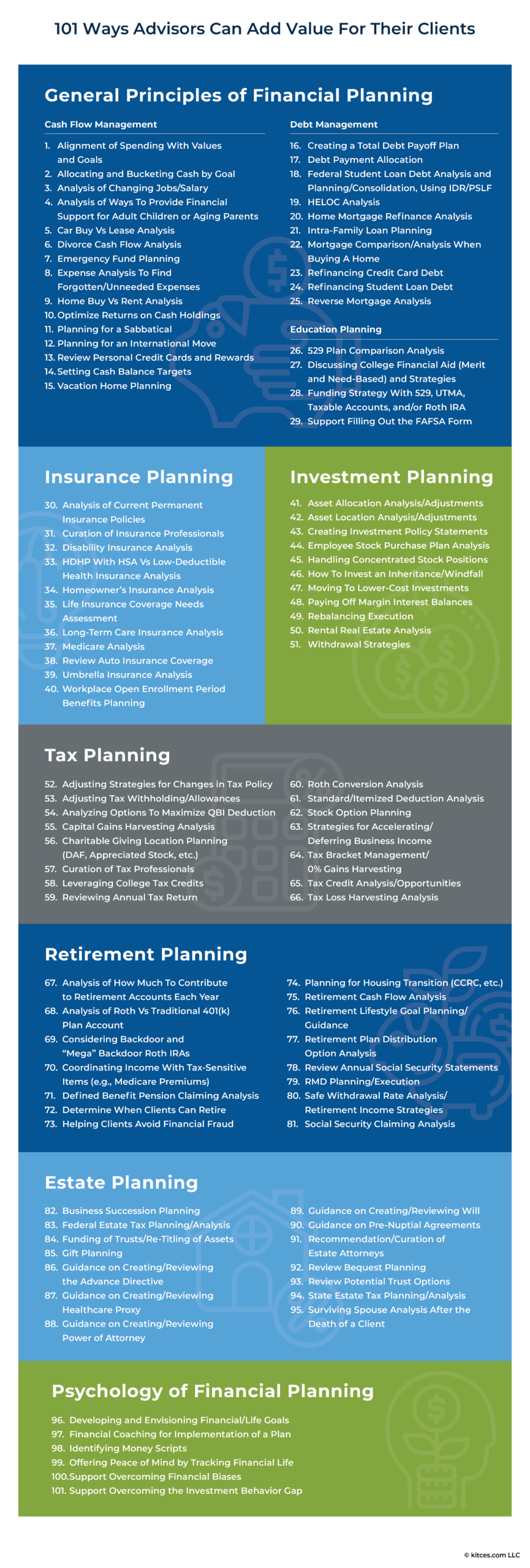

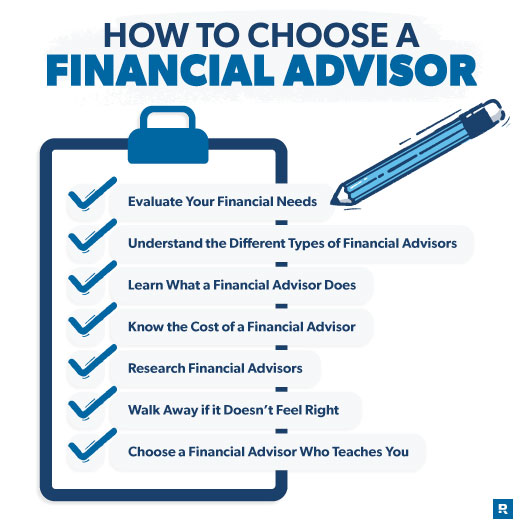

Some will analyze your entire monetary picture and aid you develop a detailed strategy for accomplishing your economic goals. Others, nonetheless, will advise just the products they offer, which could give you a restricted array of choices. Unlike other careers discussed in this section, the economic preparation profession doesn't have its very own regulatory authority.For example, an accountant - Financial Services in St. Petersburg, FL who prepares monetary strategies is managed by the state Board of Accountancy, and a financial coordinator who's likewise an financial investment consultant is managed by the Securities and Exchange Commission or by the state where the adviser operates. If an organizer you're taking into consideration makes use of a particular professional designation, look into that credential utilizing our Specialist Classifications lookup device. Various other organizers could hold a credential that is even more hard to obtain and to maintain, such as the CERTIFIED FINANCIAL coordinator classification, or CFP, provided by the Licensed Financial Coordinator Board of Specifications. This qualification needs a minimum of three years of experience, imposes fairly rigorous standards to gain and keep, permits financiers to confirm the condition of anybody claiming to be a CFP and has a disciplinary procedure

An insurance coverage agent will tell you about insurance products (such as life insurance policy and annuities) but most likely will not review various other financial investment options (such as supplies, bonds or shared funds) - Financial Advisor in St. Petersburg. You'll intend to ensure you totally recognize which locations of your monetary life a particular planner canand cannothelp with prior to you work with that person

All About Fortitude Financial Group

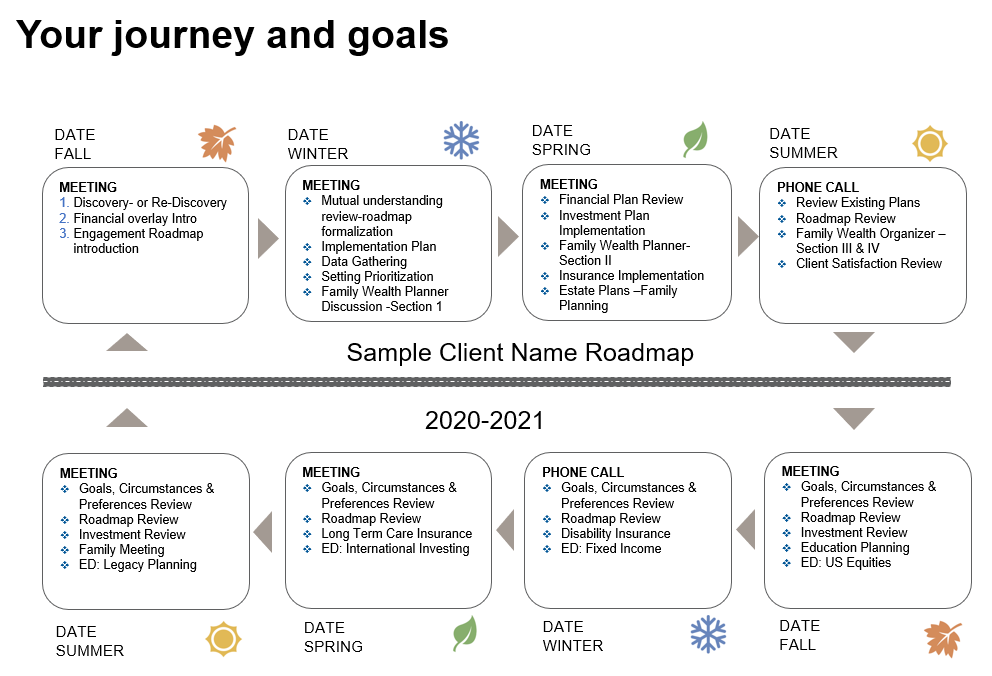

Any individual can take advantage of experienced monetary adviceno issue where they're beginning with. Our economic consultants will certainly check out your broad view. They'll think of all the what-ifs so you do not need to and guide you via life events huge and small, like spending for university, purchasing a residence, getting wedded, having a baby, embracing a youngster, retiring or inheriting properties.

I estimate that 80% of physicians require, want, and must use a monetary expert and/or an investment supervisor. Some financial investment gurus such as William Bernstein, MD, believe my price quote is way as well reduced. At any rate, if you wish to use a consultant briefly or for your whole life, there is no reason to feel guilty concerning itjust see to it you are getting great advice at a fair cost.

See all-time low of the web page for more details on the vetting. At Scholar Financial Advising we help physicians and individuals with complicated monetary requirements by supplying economic suggestions that they can implement on a hourly project or monthly retainer basis. Our advisors hold at minimum a Ph. D. in Finance and Stephan Shipe, the firm's lead advisor, is also a CFA charterholder and CFP Professional.

The Fortitude Financial Group Diaries

With each other, we will browse the complexity of day-to-day life by crafting a streamlined economic plan that is agile for your advancing needs - https://fortitudefg1.bandcamp.com/album/fortitude-financial-group. We will aid you utilize your riches to free up energy and time to focus on your household, your practice, and what you enjoy a lot of. Chad Chubb is a Certified Economic Planner (CFP) and Qualified Trainee Finance Professional (CSLP)

He established WealthKeel LLC to simplify and organize the economic lives of doctors throughout the United States by custom-crafting economic plans centered around their objectives and worths. WealthKeel is recognized by The White Layer Capitalist as one of a few choose firms identified as "an excellent financial consultant at a reasonable rate," for their flat-fee subscription model and likewise their capped cost framework.

($9,500) for All. Collaborate with us if: You're retired or will you can try this out retire in the next 7 years You have an overall profile of $2M+ You're worried concerning generating & safeguarding earnings permanently You intend to manage the 10+ essential retirement earnings dangers extra proactively You do not such as bothersome fee structures (% of assets, flat however tiered, payments) We'll construct you a customized.

Rumored Buzz on Fortitude Financial Group

We can aid you create a cost savings and financial investment strategy, so you know where to put your added income. We can also aid with various aspects of your financial life including financial debt monitoring (trainee financing preparation), tax obligation preparation, and investment techniques. Our goal is to identify the most reliable and adaptable means for clients to build wealth and reach their financial objectives.

Physicians have one-of-a-kind monetary issues that can often feel frustrating. As locals, others, and early-career physicians, you deal with squashing trainee car loan financial debt and contending economic goals like beginning households and acquiring homes.